Investing, as everyone knows, is a game of patience. You need to have the patience to ride out market busts and resist the attempt to sell during market booms. On the other hand, Traders (a.k.a speculators) have a much shorter time frame as shown below:

- Scalpers : Less than a second to few seconds.

- High Frequency Traders a.k.a. Algorithmic Traders : Order of miliseconds

- Momentum Traders: minutes to few hours

- Swing Traders : A day to a few weeks

- Trend followers / Position Traders : Weeks to Months

The unifying factor in all these types of trading is that they rely heavily on technical analysis and trend following tactics. The odds of getting them right for *really smart* guys is about 50% !!! hence the name "Speculators". :)

Now, coming back to the topic under discussion - I started to ask myself, historically (again no future prediction involved), what is the minimum holding time for long term investors to make money - so I analyzed the rate of returns of the S&P from 1950 to 2010 in 10 year and 20 year investment horizons. The results are summarized below:

Some observations about the data above:

1. Notice how usually 2 bull market phases is followed by a Bear or Sideways market phase. This is what is effectively called "Reversion to the Mean" in efficient market hypothesis !

2. For a stretch of 10 year period, assuming you bought at the beginning of the decade and sold at the end of the decade, you'd have made money in 5 of the 6 decades, which is not bad !

3. The average ROI for a 10 year time horizon is 234% - i.e. 100K becomes 234k

4. For a 20 year holding period, you NEVER LOST MONEY !!!

5. The average ROI for 20 year period is 533% - i.e. 100K becomes 533K over a 20 year investment period.

6. For a 30 year period, the average ROI is 955%, i.e. 100K became 955K .

Note: The above data is not adjusted for increase in CPI (inflation)

To quote Warren Buffet " Our preferred holding period is forever" - now you can see why :) Agreed, that if you're smart and can use trend following strategies, you can make a lot more money (like 2000% more over 10 years ), but you can also loose everything !

So, parting words of wisdom :

1. If you're in your 20's , Index investing is the best way to go. Use dollar cost averaging to get the best risk adjusted returns.

2. DO NOT, I repeat DO NOT Trade or try to use Trend Following techniques in your 401k and IRA accounts.

3. Invest money that you do not need for at least 10 years - anything shorter, and you run a big risk of loosing money if your timing is incorrect - after all, even over 10 year investing periods, you have a 17% chance of loosing money.

4. I know that you're thinking this Index investing and dollar cost averaging is for the idiots - but 20 years from now, these will be the idiots with money !

5. If the thrill of Trend following and technical trading really excites you, divide your portfolio as follows:

A. Retirement Accounts : These includes IRA and 401K - index investing is the way to go.

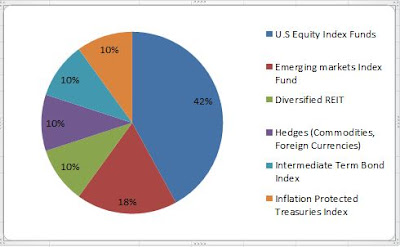

B. Brokerage Investment Account: Typically here you'll save for a specific goal like buying a house. Use conservative investing practices. An example Portfolio(assuming you're in your 20s and 30s) is given below:

C. Brokerage Speculative Account : This is the FUN PART ! And after all, this is what this blog is all about. Note that you should not speculate with more than 10% of your portfolio !

Well, hopefully you have a better grasp of what "Long Term Investment" means after reading this article - where you go from here - is a path you have to choose !